Private Lending

What is a Private

Lending?

- (949) 554-3682

Lorem Ipsum is simply dummy text

Invoices

Lorem Ipsum is simply dummy text of the printing and typesetting industry.Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Collections

Lorem Ipsum is simply dummy text of the printing and typesetting industry.Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Imbursement

Lorem Ipsum is simply dummy text of the printing and typesetting industry.Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Avg. Term Length: 24 - 60 months

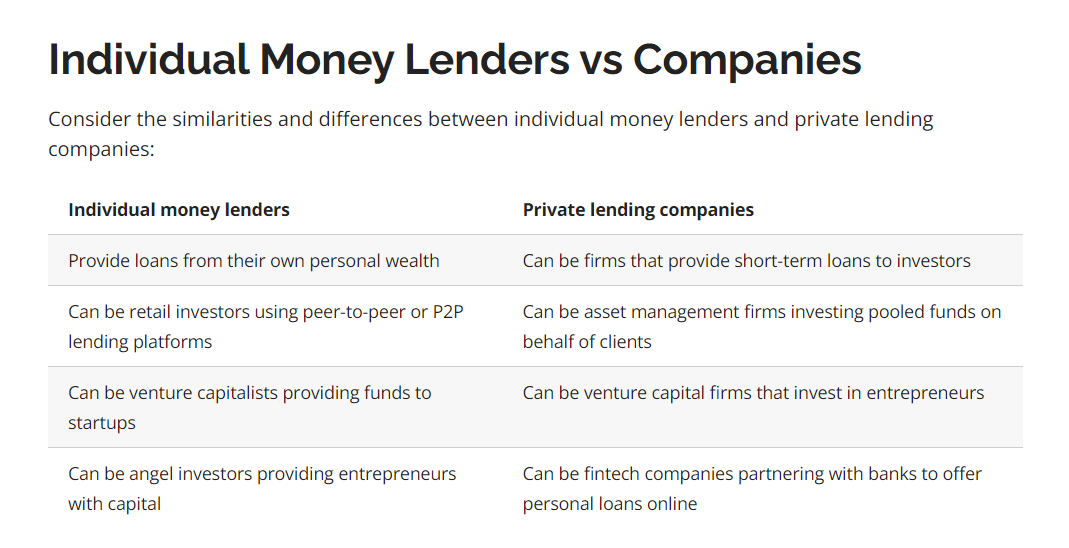

Private Lending Company

Here are some examples of private lending companies:

- Financial technology or fintech groups

- Private equity firms

- Venture capital firms

- Hedge fund managers

- Business development companies

- Investment managers

Individual Private Lender

An individual private lender is any person who offers loans to any consumer or business. Here are some examples of individual private lenders:

- Venture capitalist

- Private equity investor

- Angel investor

- Peer-to-peer lender

- Personal investor

- Retail investor

Why Choose Us?

Unlike traditional banks and other alternative lenders, at IBF, we truly value your business. Your success is most important to us, so we’ll never over-leverage your business by offering you more funding than you can handle. Our simple application and quick approval process makes it easy for you to get the working capital your business needs, and our experienced funding consultants will walk with you every step of the way.

- (949) 554-3682

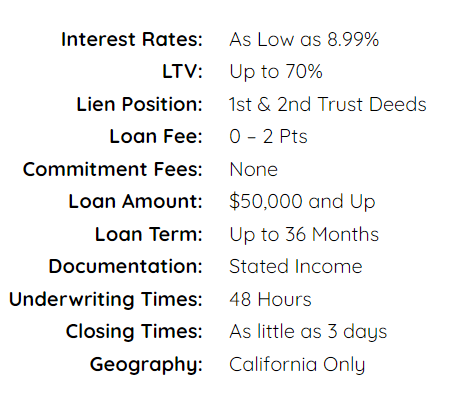

Hard Money Loan Lending Parameters

Traditional Hard Money Loan

General Guidelines

– Will make exceptions up to 120 months.

– Par pricing options available on most loan offers.

– Strong verifiable income is a compensating factor.

– 75% LTV Allowed via 1st & 2nd trust deed

– Closing in 3-7 days requires a full file at submission

– 2nd Trust Deeds must be subordinate to institutional 1st

Construction Loans

The strength/experience of the principal/sponsor is a key part for this private money construction loan program. Typically, we will broker with a lender that will lend up to 75% of the cost of the project. We will focus on shovel/ready construction projects.

| Interest Rates: | As Low as 9.99% |

| LTV: | Up to 75% of Cost |

| Lien Position: | 1st Trust Deeds Only |

| Loan Fee: | Starting at 2 pts |

| Commitment Fees: | CBC |

| Loan Amount: | $500,000 and up |

| Loan Term: | Up to 24 Months w/ Extensions |

| Documentation: | Stated Income |

| Underwriting Times: | 48 Hours |

| Closing Times: | 30 Days+/- |

Here is a real-world example of the program:

| Purchase Price | $85,000 |

| After Repair Value: | $160,000 |

| Loan Amount: | $105,000 (65% of ARV) |

| Interest Rate: | Starting at 11% |

| Interest Reserve: | 3 – 12 Months |

| Points: | Starting at 2 Points |

| Site Inspection Fee: | $250 – $1500 |

| Loan Term: | 6 – 24 Months |

| Geography: | California Only |

| Fund Control: | $20,000 |

| Closing Times: | 14 Days from Site Inspection |

| Funds to Close: | $17,000 |

Geography: CA Only

General Guidelines

Strong verifiable income is a compensating factor.

Land Loans/Lot loans:

| interest Rates: | As Low as 9.99% |

| LTV: | Up to 50% |

| Lien Position: | 1st Trust Deeds Only |

| Loan Fee: | Starting at 2 pts |

| Commitment Fees: | CBC |

| Loan Amount: | $100,000 and up |

| Loan Term: | Up to 24 Months w/ Extensions |

| Documentation: | Stated Income |

| Underwriting Times: | 48 Hours |

| Closing Times: | 30 Days+/- |

| Geography: | CA Only |

General Guidelines

50% max LTV for infill lots

Lower LTV offered for acreage.

What is a Land Loan?

Loan for Raw Land

Loan for Lot Land

Advantages

- Lorem Ipsum is simply dummy text of the printing

- Lorem Ipsum is simply dummy text of the printing

- Lorem Ipsum is simply dummy text of the printing

Disadvantages

- Lorem Ipsum is simply dummy text of the printing

- Lorem Ipsum is simply dummy text of the printing